Starting your investment journey can feel overwhelming, especially with countless options and conflicting advice everywhere. Whether you're a first-time investor or looking to optimize your existing portfolio, finding the right wealth management services in Kerala makes all the difference between financial stress and financial success. Professional guidance helps you navigate market volatility, tax implications, and long-term wealth creation with confidence.

Key Takeaways

Wealth management services provide comprehensive financial planning, from investments to insurance and retirement planning.

Kerala's growing economy offers unique opportunities for investors seeking localized expertise and personalized strategies.

Professional wealth managers help you avoid costly mistakes, optimize tax benefits, and build diversified portfolios aligned with your goals.

Why Wealth Management Matters for Kerala Investors

Kerala's unique economic landscape, characterized by high literacy rates, NRI remittances, and a growing middle class, creates distinct financial planning needs. Many investors struggle with deciding between traditional investments like gold and real estate versus modern options like mutual funds and equities. This is where professional wealth management services in Kerala become invaluable.

A wealth management firm doesn't just manage your money. They become your financial partner, understanding your dreams, risk tolerance, and life goals. From planning your child's education abroad to ensuring a comfortable retirement, comprehensive wealth management covers every aspect of your financial life.

Understanding Comprehensive Wealth Management

What Wealth Management Actually Includes

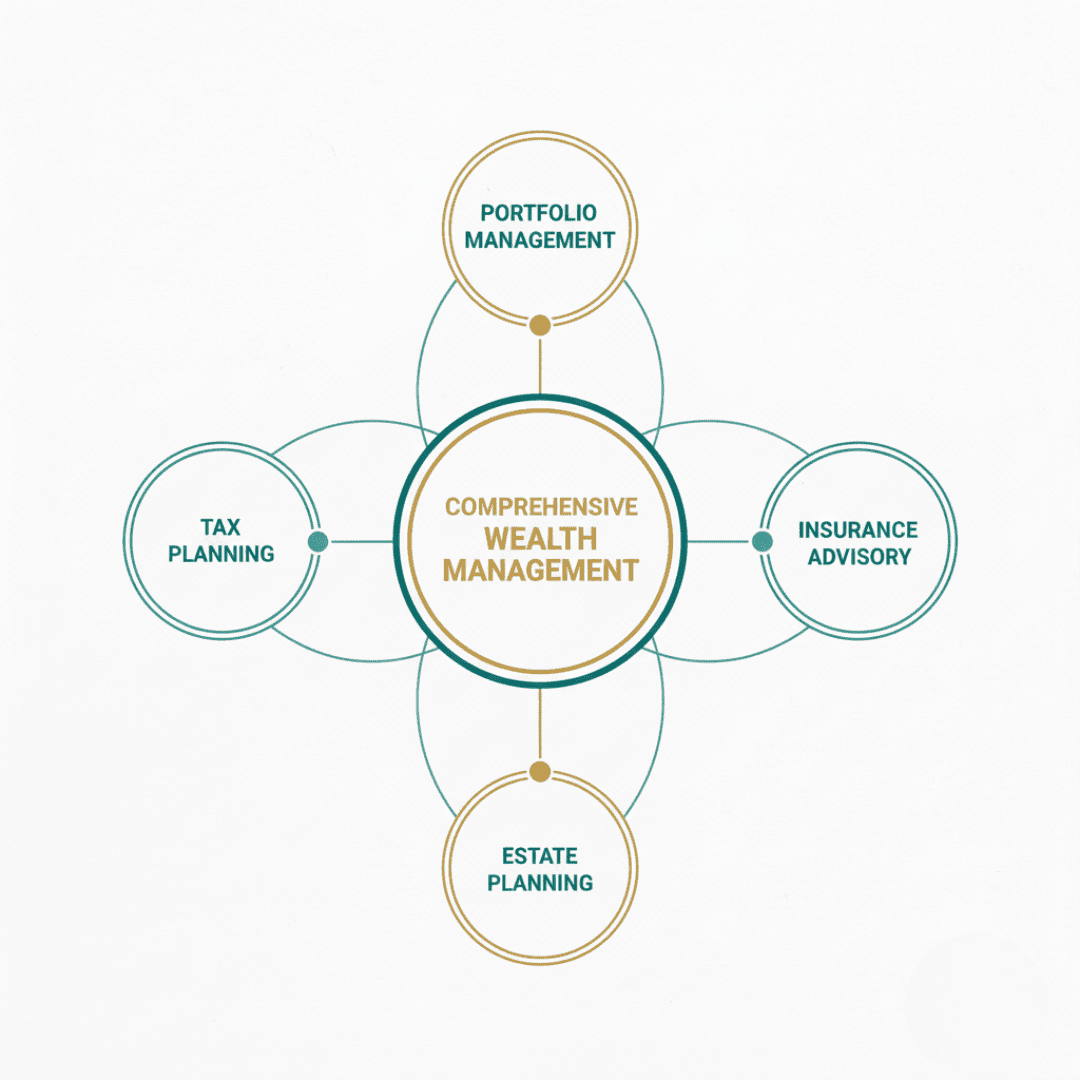

Wealth management goes far beyond simple investment advice. It's a holistic approach that integrates multiple financial services under one umbrella. When you work with the best wealth management firms, you gain access to portfolio management, tax planning, estate planning, insurance advisory, and retirement planning.

Think of it like having a personal CFO for your family. Instead of juggling multiple advisors for different needs, you get coordinated strategies that work together. For instance, your investment strategy considers your insurance coverage, and your tax planning aligns with your retirement goals.

Key components include:

Portfolio Management Services: Professional oversight of your investment portfolio with regular rebalancing and performance tracking

Risk Assessment: Evaluating your risk appetite and creating strategies that match your comfort level

Goal-Based Planning: Structuring investments around specific life goals like buying a home, funding education, or retirement

Tax Optimization: Leveraging tax-efficient investment instruments to maximize your returns

The Kerala Advantage: Local Expertise Matters

Working with a financial advisor Kerala based brings specific advantages. Local advisors understand regional investment patterns, NRI investment regulations, and Kerala-specific tax implications. They're familiar with local real estate markets, regional business opportunities, and the unique financial challenges Kerala families face.

Kerala investors often have international exposure through family members working abroad. A local wealth manager can help structure NRI investments, manage foreign remittances efficiently, and create strategies that leverage both domestic and international opportunities.

Seven Compelling Reasons to Choose Professional Wealth Management

1. Personalized Financial Strategies

Generic investment advice rarely works. Your financial situation is unique, shaped by your income, expenses, family structure, and dreams. Professional wealth managers conduct detailed financial health assessments before recommending any strategy.

They consider factors like your current age, retirement timeline, dependent family members, existing assets, and future income projections. This comprehensive analysis ensures every recommendation fits your specific circumstances. For example, a 30-year-old starting their career needs different strategies compared to a 50-year-old planning retirement.

2. Diversification That Actually Works

"Don't put all eggs in one basket" sounds simple, but implementing effective diversification requires expertise. Many investors think buying multiple mutual funds equals diversification, but they might unknowingly hold overlapping stocks across those funds.

Emotional investing is wealth's biggest enemy. Market volatility triggers fear and greed, leading to poor decisions like panic selling during downturns or chasing hot stocks during rallies. Professional wealth managers bring discipline to your investment process.

They implement systematic strategies like Systematic Investment Plans (SIP) that remove emotion from investing. Regular investments regardless of market conditions leverage rupee-cost averaging, where you buy more units when prices are low and fewer when prices are high. This disciplined approach has historically outperformed market timing attempts.

4. Access to Exclusive Investment Opportunities

Retail investors typically access only publicly available investment options. Professional wealth management firms often provide access to exclusive opportunities like pre-IPO placements, structured products, portfolio management schemes, and alternative investments.

The best wealth management firms maintain relationships with fund houses, investment banks, and corporate entities, giving their clients first access to promising opportunities. They also conduct thorough due diligence, ensuring you don't fall prey to unsuitable or risky investments.

5. Comprehensive Financial Health Monitoring

Your financial situation constantly evolves. Income changes, family needs shift, markets fluctuate, and regulations update. Without regular monitoring, your financial plan quickly becomes outdated.

Professional wealth managers conduct periodic financial health checkups, reviewing your portfolio performance, rebalancing asset allocation, and adjusting strategies based on life changes. They track whether you're on course to meet your goals and make timely corrections when needed.

Regular monitoring includes:

Quarterly portfolio performance reviews

Annual goal progress assessments

Tax-loss harvesting opportunities

Rebalancing to maintain target asset allocation

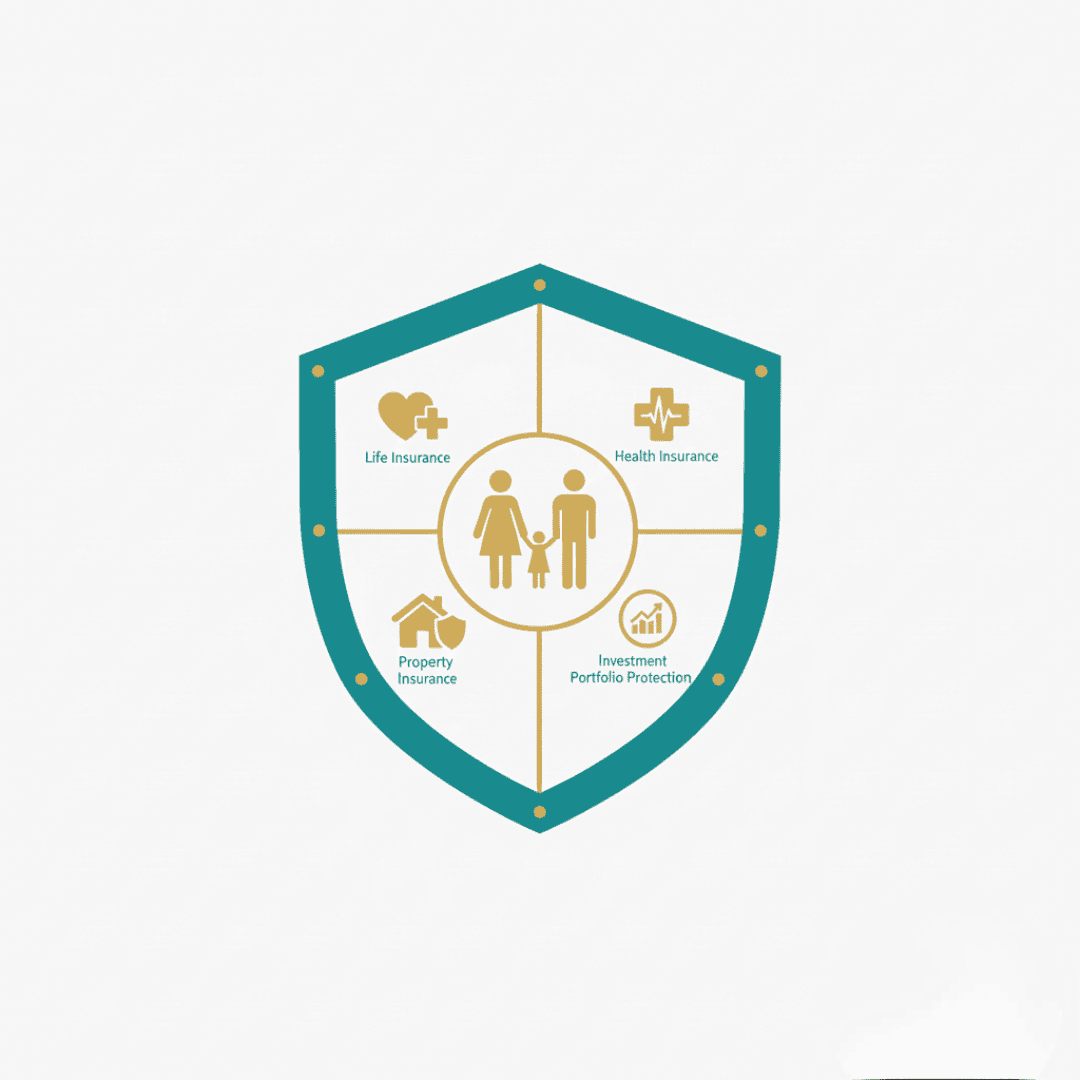

6. Integrated Insurance and Risk Management

Wealth creation and wealth protection go hand-in-hand. Many investors focus solely on growing their money while overlooking adequate insurance coverage. This creates vulnerability where one medical emergency or unfortunate event can derail years of careful saving.

Comprehensive wealth management services in Kerala integrate insurance planning into your overall financial strategy. They assess your life insurance needs based on family obligations, recommend appropriate health insurance coverage, and ensure your growing wealth stays protected. The goal is building a fortress around your financial future, not just a bigger pile of money.

7. Tax-Efficient Investment Strategies

Taxes significantly impact your actual returns. A 12% return becomes just 8.4% after 30% tax. Professional wealth managers structure portfolios to maximize tax efficiency through instruments like ELSS funds, tax-free bonds, and strategically timed capital gains harvesting.

They understand current tax regulations, upcoming changes, and legitimate ways to minimize your tax burden. For Kerala investors, this includes optimizing between long-term and short-term capital gains, utilizing indexation benefits, and structuring investments to leverage available deductions.

How to Choose the Right Wealth Management Partner

Credentials and Experience Matter

When selecting a financial advisor Kerala, verify their credentials, certifications, and track record. Look for advisors with recognized qualifications like CFP (Certified Financial Planner), CFA (Chartered Financial Analyst), or equivalent credentials. Experience matters especially in navigating market cycles and crisis periods.

Ask about their investment philosophy, typical client profile, and how they handle market downturns. A good advisor should explain complex concepts clearly without using jargon that confuses rather than clarifies.

Transparency in Fees and Processes

Understanding how your advisor gets compensated is crucial. Some charge fixed fees, others take a percentage of assets managed, and some earn commissions on products sold. Each model has pros and cons, but transparency is non-negotiable.

Reputable firms clearly explain their fee structure, potential conflicts of interest, and how they prioritize your interests. They provide detailed reporting on portfolio performance, transactions, and fees charged. This transparency builds trust and ensures alignment between your goals and their recommendations.

Technology and Accessibility

Modern wealth management combines human expertise with technology. Look for firms offering online portfolio access, mobile apps for tracking investments, and digital communication channels. However, technology should enhance, not replace, personalized human advice.

The best arrangement provides convenience through technology while maintaining access to experienced advisors when you need guidance. Whether you prefer face-to-face meetings, video calls, or digital updates, your wealth manager should accommodate your communication preferences.

Common Wealth Management Mistakes to Avoid

Waiting for the "Perfect Time" to Invest

Many potential investors wait for market corrections, economic stability, or more savings before starting their investment journey. This waiting game often means missing years of potential compound growth. The best time to start investing was yesterday; the second-best time is today.

Even small amounts invested consistently through portfolio management services grow significantly over time. Starting with whatever you can afford, even ₹1,000 monthly, establishes the investing habit and captures market opportunities.

Ignoring Risk Management and Insurance

Focusing exclusively on returns while ignoring risk is a recipe for financial disaster. Every investment strategy should balance growth potential with downside protection. This includes appropriate asset allocation, stop-loss strategies when relevant, and adequate insurance coverage.

Young investors often skip insurance thinking they'll add it later. However, insurance becomes more expensive with age and health conditions. Comprehensive wealth management addresses protection needs alongside growth objectives from day one.

Frequent Portfolio Changes

Constantly tweaking your portfolio based on market news or tips from friends usually hurts more than helps. Every transaction incurs costs, and frequent changes prevent strategies from playing out fully. Professional wealth managers resist the urge to make unnecessary changes, intervening only when fundamentals shift or rebalancing is needed.

Research shows portfolios with lower turnover often outperform those with frequent trading. Patience and consistency typically beat constant activity in long-term wealth creation.

The Future of Wealth Management in Kerala

Kerala's financial landscape is rapidly evolving. Increased financial literacy, digital adoption, and growing disposable incomes are creating sophisticated investors who demand more than basic investment advice. The best wealth management firms are responding with enhanced services, better technology, and more personalized approaches.

Younger generations, particularly millennials and Gen Z investors, bring different expectations. They value transparency, social responsibility, and digital convenience alongside traditional wealth creation. Forward-thinking asset management companies in Kerala are integrating ESG (Environmental, Social, Governance) considerations, offering sustainable investment options, and leveraging AI for better insights.

The integration of artificial intelligence and data analytics is making wealth management more precise. Advisors can now analyze larger datasets, identify patterns, and create more optimized portfolios. However, the human element remains irreplaceable for understanding emotional aspects, life goals, and providing reassurance during market volatility.

Taking the First Step Toward Financial Security

Choosing professional wealth management services in Kerala isn't about having millions to invest. It's about making smart decisions with whatever resources you have and building toward your financial goals systematically. Whether you're starting with a small SIP or ready to invest larger amounts, professional guidance helps you avoid costly mistakes and stay on track.

The journey to financial security begins with a single conversation. Reach out to experienced financial advisors in Kerala who understand your unique needs, local market dynamics, and long-term wealth creation strategies. With the right partner guiding your financial decisions, you can focus on living your life while your money works efficiently toward your dreams.

Remember, wealth management isn't just for the wealthy. It's for anyone serious about building a secure financial future. The earlier you start, the more time compound growth has to work its magic on your investments.

Ready to take control of your financial future? Contact Hedge Equities today for a comprehensive financial consultation and discover how professional wealth management can transform your financial life.